avis3d.ru

Tools

Can I Buy A Car With No Credit

Many dealerships offer no-credit auto loans, though we recommend avoiding buy-here, pay-here car dealers if possible. How fast can you build credit? Get a co-signer – A lot of first-time borrowers use a co-signer as a way to get their credit started. Just remember, that if you can't pay the loan, your co-. Absolutely, getting an auto loan with a limited credit history is possible, but it's akin to trying to start a campfire with damp wood: it'll. Our goal is % credit approval and you won't need to make any payments for 90 days. Our instant credit approval process is perfect for our customers with bad. Some bank lenders will work with you even if you haven't yet established a credit history. In this case, you'll need to prove you have a steady paycheck or. If you have a poor credit score – or no credit history at all – don't worry too much about buying a new car. Financing a car with no credit is absolutely. The answer is: yes! While the process will be a little more complicated than financing with an established credit score or a good credit score, Kennesaw drivers. Get Pre-approved Since dealerships obviously want to sell cars, they will usually try to work with buyers who have no credit history. But it usually is better. Regardless of your bad, poor or no credit status, we work hard to get you a car loan that works for your budget. The great thing is that when you get a bad. Many dealerships offer no-credit auto loans, though we recommend avoiding buy-here, pay-here car dealers if possible. How fast can you build credit? Get a co-signer – A lot of first-time borrowers use a co-signer as a way to get their credit started. Just remember, that if you can't pay the loan, your co-. Absolutely, getting an auto loan with a limited credit history is possible, but it's akin to trying to start a campfire with damp wood: it'll. Our goal is % credit approval and you won't need to make any payments for 90 days. Our instant credit approval process is perfect for our customers with bad. Some bank lenders will work with you even if you haven't yet established a credit history. In this case, you'll need to prove you have a steady paycheck or. If you have a poor credit score – or no credit history at all – don't worry too much about buying a new car. Financing a car with no credit is absolutely. The answer is: yes! While the process will be a little more complicated than financing with an established credit score or a good credit score, Kennesaw drivers. Get Pre-approved Since dealerships obviously want to sell cars, they will usually try to work with buyers who have no credit history. But it usually is better. Regardless of your bad, poor or no credit status, we work hard to get you a car loan that works for your budget. The great thing is that when you get a bad.

Short answer: Yes, you can finance a car with no credit. In fact, you can finance a car with outright bad credit. There are challenges, but it's not. Even with no, low, or bad credit, you can buy a car with a no-credit check car loan. Making payments on time can help build your credit for the future. Get. Honestly you don't need credit to buy a car. No credit is fine for a first time buyer! I worked at a dealership and bought my first car with a. Financing a car with bad credit or even no credit is definitely possible though it might be more challenging than financing with somewhat decent credit. Yes, you absolutely can! In the past, a credit history was usually a requirement for getting an auto loan, but that's not always the case today. Buy a vehicle in Union even if you have little to no credit. Speak to our finance center to see your options for financing a car. Financing a car with no credit isn't always easy, but it is often possible. Whether you're a first-time car buyer with no credit or a driver who's exploring. How to buy a car with bad credit · Check all your options · Make a larger down payment · Find a co-signer · Manage your expectations · Build your credit score. Securing financing for a new car can be tricky with no credit, but it's not impossible. As with any other loan, it's smart to shop around for a new auto loan. Is your credit score less than ideal? Are you a first-time car buyer with no credit? While financing a car with no credit or financing a car with bad credit. But if you're willing to do the necessary legwork, including offering a significant down payment and searching for a reputable no-credit lender, you may be able. While it's true that having a bad credit score or a lack of credit history can make it more challenging to secure financing – it's still very possible! Many of. Whether this is your first time buying a car but you don't have credit or your credit is less than an ideal but you need a vehicle in Tampa, it is actually. Having bad credit shouldn't be the only thing standing between you and your new vehicle. It doesn't mean that you can't get a car loan, only that you need to. Yes, you can! While it may be more difficult, it's not impossible. Learn more about no credit car loans and even financing a car with bad credit with our. Securing financing for a new car can be tricky with no credit, but it's not impossible. As with any other loan, it's smart to shop around for a new auto loan. Car-shoppers with bad credit can still buy a car, but they should take a few extra steps to ensure they are getting a fair deal. First, any increase you can. Utilize a Buy Here, Pay Here Dealership · Research Multiple Lenders · Find Ways to Improve Your Credit In the Short-Term · Pay With Cash · Use a Loan Cosigner. Tips for Financing a Car with Bad Credit or No Credit · Invigorate your credit score. · Budget carefully and know your credit score · Ask a lot of questions and. Be prepared. If you have no credit, you can expect to be asked at the dealership, "How much will you be putting down on the vehicle?" Don.

Drain Line Repair Cost

When it comes to replacing a sewer line, there is no one-size-fits-all. On average, the cost of replacing a sewer line can range from $3, to $6, $49 Sewer Line Repair Diagnostic, Waived With Repair · We will come to your home · Diagnose the problem with your Sewer Line · Provide a comprehensive report on. Jones Services is Proudly & Professionally Offering Sewer Line Repair Services in the Goshen, New York area. Check out all of our current offers! Relatively simple jobs for residential single-family homes can cost as little as $ to $ Some contractors may price it as a base cost plus a per foot. Expect to pay about $$ per foot, or $3,$20, for an average household sewer line depending on the type, length and depth of the existing pipe, plus. Repairing a cracked sewer line buried outside can cost between $1, and $4, That price is between $75 and $ per linear foot. sewer line replacement. The national average drain line breakage repair cost is between $ and $1,, with most people paying around $ to detect and repair a broken drain pipe. As we mentioned above, sewer line replacement can sometimes cost anywhere from $3, to $20, (and sometimes even more than that). Typically, homeowners. Many contractors charge a dollar amount per each foot of pipe being replaced, but other determining factors include accessibility of the pipe, the extent of. When it comes to replacing a sewer line, there is no one-size-fits-all. On average, the cost of replacing a sewer line can range from $3, to $6, $49 Sewer Line Repair Diagnostic, Waived With Repair · We will come to your home · Diagnose the problem with your Sewer Line · Provide a comprehensive report on. Jones Services is Proudly & Professionally Offering Sewer Line Repair Services in the Goshen, New York area. Check out all of our current offers! Relatively simple jobs for residential single-family homes can cost as little as $ to $ Some contractors may price it as a base cost plus a per foot. Expect to pay about $$ per foot, or $3,$20, for an average household sewer line depending on the type, length and depth of the existing pipe, plus. Repairing a cracked sewer line buried outside can cost between $1, and $4, That price is between $75 and $ per linear foot. sewer line replacement. The national average drain line breakage repair cost is between $ and $1,, with most people paying around $ to detect and repair a broken drain pipe. As we mentioned above, sewer line replacement can sometimes cost anywhere from $3, to $20, (and sometimes even more than that). Typically, homeowners. Many contractors charge a dollar amount per each foot of pipe being replaced, but other determining factors include accessibility of the pipe, the extent of.

When it comes to replacing a sewer line, there is no one-size-fits-all. On average, the cost of replacing a sewer line can range from $3, to $6, Monday to Friday, pm to 12 midnight · 1 hour. Cost, $ hours. Cost, $ · 2 hours. Cost, $ hours. Cost, $ · 3 hours. Cost. In April the cost to Repair a Kitchen Sink Drain starts at $ - $ per drain. Use our Cost Calculator for cost estimate examples customized to the. $89 Trenchless Sewer Line Repair Diagnostic + Same Day Service · We will come to your home · Diagnose the problem with your sewer line · Provide a comprehensive. Digging and replacing a sewer line costs $3, to $25,, or $50 to $ per foot. Trenching costs $4 to $12 per foot and may be a necessity. Cast iron pipes: The cost of replacing a drain pipe with cast iron pipes can range from $70 to $+ per linear foot. Excavation: If excavation is needed to. If it is roughly 25 ft, no walkway is affected, it might cost somewhere between $ to $ to dug up and replace the sewer line in Bay Area. It can cost anywhere from $ - $ to repair your sewer line in Denver. Here are 6 factors that will affect the final price. The longer the sewer line, the more materials and labor will be required. Contractors typically charge per linear foot for both the removal and installation of. The cost to replace a sewer line completely generally costs $50 to $ per foot and can add up to something like $25, A sewer line typically needs. It can cost anywhere from $ - $ to repair your sewer line in Denver. Here are 6 factors that will affect the final price. The average sewer line replacement can cost anywhere between a few thousand dollars and $25, In short, the reason for this price is because a sewer line. You can expect pipe lining to cost anywhere between $80 to $ per linear foot. There is a wide range in price because the true cost varies from project to. How Much Does It Cost To Replace A Sewer Line? The cost of replacing a sewer line usually ranges from about $3, to $25, This price can change based on. In April the cost to Install a Drain Line starts at $ - $ per piping run. Use our Cost Calculator for cost estimate examples customized to the. The cost is as much as $ per linear foot. And total replacement using both methods can cost from a few thousand dollars to north of $25, Whether. Pipe restoration is most often completed with cured-in-place pipe lining (CIPP) technology, and the range for pipe lining falls between $80 per linear foot and. Sewer Main Line Repair Company Near Vernon, BC · $ Sewer Line Repair Diagnostic · Sewer Line Installation For As Low As $/Mo · Trust the Local Vernon. The cost of repairing a sewer line ranges from $4, to $25, Sewer line replacement costs range from $92 to $ per foot on average. The estimated cost of.

Homedepot Card Payment Online

For online purchases we accept Visa, MasterCard, American Express and DiscoverCard. We also accept The Home Depot Consumer Credit Card, as well as The Home. The Home Depot offers electronic access to W-2 statements and options to update tax withholding elections. Via Self Service, you may: set up/change payment. Visit the Home Depot Credit Cards page to pay and manage your card. You haven't saved any credit cards. Add a credit card for quick and easy checkout the next. From the Make a Payment page, select a payment amount, payment source and payment date Can I use a Gift Card to purchase my online order? Yes. The Home Depot. Check your purchasing power and see your payment options from the palm of your hand. The Affirm Card™. Request to pay over time for the big stuff, or just pay. Additionally, it provides online account management, detailed billing statements, and the option to provide cards to employees. This account is suitable for. To make online payments at no charge, click the Payments menu, then click the link to add a payment account or make a payment. For an external source, you'll. Enjoy the flexibility of paying your full balance or just the minimum payment due each month. 24/7 customer service. Questions about your Citi ® card account? Home Depot offers convenient, affordable, credit card options to extend their purchasing power as well as manage and pay their account. For online purchases we accept Visa, MasterCard, American Express and DiscoverCard. We also accept The Home Depot Consumer Credit Card, as well as The Home. The Home Depot offers electronic access to W-2 statements and options to update tax withholding elections. Via Self Service, you may: set up/change payment. Visit the Home Depot Credit Cards page to pay and manage your card. You haven't saved any credit cards. Add a credit card for quick and easy checkout the next. From the Make a Payment page, select a payment amount, payment source and payment date Can I use a Gift Card to purchase my online order? Yes. The Home Depot. Check your purchasing power and see your payment options from the palm of your hand. The Affirm Card™. Request to pay over time for the big stuff, or just pay. Additionally, it provides online account management, detailed billing statements, and the option to provide cards to employees. This account is suitable for. To make online payments at no charge, click the Payments menu, then click the link to add a payment account or make a payment. For an external source, you'll. Enjoy the flexibility of paying your full balance or just the minimum payment due each month. 24/7 customer service. Questions about your Citi ® card account? Home Depot offers convenient, affordable, credit card options to extend their purchasing power as well as manage and pay their account.

It's over $ I have a couple of Home Depot gift cards. Can I use several gift cards, plus credit card to pay for one order online? How to Use Other Payment Methods at Home Depot · In-Store: Use your credit/debit card or PayPal at checkout. For PayPal, scan the QR code if available. · Online. You may purchase a Canadian The Home Depot® Gift Card online at avis3d.ru Can I use my Gift Card toward loan payments? No. The Home. Welcome to GreenSky® Guest Payment Portal! To make a payment, please enter your application information below. Application ID. You can make an Online Payment once you enroll. Your payment will credit to your account as described in the paragraph titled "Same Day Crediting". If you use a. At checkout, make sure to always pay with a registered card at the card reader. Apple Pay & Mobile Payments click to copy link. For in-store purchases. Wallet, Pay, Card · Siri · Watch. Explore Watch. Explore All Apple Watch I bought wat I was looking for online, and got it the next day. I will never. PROJECT LOAN PAYMENT EXAMPLES. Loan Amount, Monthly Payments ($20 per $1, borrowed)***. $1,, $ $5, Cardholders can manage their Home Depot Credit Card account online through the Citibank website. This allows you to view your bill cycle, make payments, check. You can manage your RBC credit card anytime, anywhere with RBC Online Banking. Pay your bill right away or set up automated recurring payments. Payment Methods. Cards & Accounts · Home Depot Credit Cards · Instant Checkout Pay Your Credit Card · Order Cancellation · Return Policy · Refund Policy. Pay your The Home Depot Card (Citi) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple. To use your card online, first add selected items to cart. At checkout, under the Payment tab, choose “apply a gift card” and insert your card number and. Payment Options. Home Depot offers various payment options, including online payments, automatic payments, and mail-in payments. Choose the. Are there payments or fees associated with the Project Loan Card? You can use the card on any purchases in-stores, online and for select Home Services. How To Make a Home Depot Credit Card Payment Online · Gather your bank account number and the ABA routing number before you start. · Navigate to the Home Depot. Pay your Wells Fargo Bank, N.A. credit card bill online, review your statement guide, find answers to your questions, or locate your credit card account. online at avis3d.ru and at any Home Depot store. Here are a few features It has no annual fees or down payments, and it offers fixed low monthly payments. Online & In-Store. $10 to $ The Home eGifter in Canada accepts. Visa. Mastercard. American Express. Discover. PayPal payment type logo. bitcoin payment. App crashes a fair bit. Found models the store sold, I couldn't find in app to compare. Some items sold online only. Again, hard to comparison shop.

Refinance Student Loan To Remove Cosigner

To remove a cosigner, it may be necessary to refinance your loan if the original loan did not offer a cosigner release option. Even though private lenders don't offer the protection of federal loans, they still have some unique perks. For example, you can potentially remove a cosigner. A co-signer can help you qualify for student loan refinancing with a lower interest rate. These lenders let you remove your co-signer in the future. Beginning June 29th, the minimum FICO score needed to refinance a student loan without a cosigner will be , down from the previous required score of The principal borrower can refinance the auto loan in their own name to remove the cosigner. The borrower gets a new loan agreement possibly from a different. Some private student loans serviced by Aspire Servicing Center offer a cosigner release benefit during the principal and interest repayment period. It may be possible to remove yourself from a co-signed student loan if the lender offers a co-signer release option. Depending on the lender, the student. The loans are based on credit, which means if a borrower does not meet BND's credit criteria, they need to apply with a creditworthy cosigner. Borrowers can. Co-signers are responsible for repaying student loans if you, the student, cannot do so on your own. · Releasing your co-signer means they are no longer. To remove a cosigner, it may be necessary to refinance your loan if the original loan did not offer a cosigner release option. Even though private lenders don't offer the protection of federal loans, they still have some unique perks. For example, you can potentially remove a cosigner. A co-signer can help you qualify for student loan refinancing with a lower interest rate. These lenders let you remove your co-signer in the future. Beginning June 29th, the minimum FICO score needed to refinance a student loan without a cosigner will be , down from the previous required score of The principal borrower can refinance the auto loan in their own name to remove the cosigner. The borrower gets a new loan agreement possibly from a different. Some private student loans serviced by Aspire Servicing Center offer a cosigner release benefit during the principal and interest repayment period. It may be possible to remove yourself from a co-signed student loan if the lender offers a co-signer release option. Depending on the lender, the student. The loans are based on credit, which means if a borrower does not meet BND's credit criteria, they need to apply with a creditworthy cosigner. Borrowers can. Co-signers are responsible for repaying student loans if you, the student, cannot do so on your own. · Releasing your co-signer means they are no longer.

Cosigner Information · Cosigners aren't required to refinance loans, but applying with a cosigner could help you secure a lower monthly payment. · Cosigners may. Why Refinance? · You should consider refinancing: if your current education loans carry a high interest rate, · if you would like to reduce your payments, · if you. Granite Edvance offers student loan refinancing for both private and federal student loans through our EdvestinU program. Remove a cosigner: Refinancing is. Private student loans may be available to students without credit histories, but there can be advantages to adding an approved cosigner to your student loan. If you can qualify for a lower interest rate, student loan refinancing can remove your co-signer and save you money. To qualify for a refinance, you'll need. Loan refinancing: Have the student borrower take out a new loan to pay off the old debt and alleviate you from responsibility. If you can be removed from the. You can remove cosigners: If you'd like to remove a cosigner from your student loans, you can do so when you refinance as you'll be paying off the old loan. Can I release a cosigner on my student loan? Yes. After making 36 consecutive on-time payments of principal and interest, a borrower may apply to release. Did you apply for a private student loan in college with a cosigner? If you have strong credit, you can refinance student loans solely in your own name to. If you have a cosigner on any of your current private student loans, refinancing those loans generally releases your cosigner from any future liability. Cons of. Refinance/Consolidation For those who do not have the option of obtaining a cosigner release, refinancing or consolidating their loans may be the only way to. Cosigners play a critical role in helping borrowers to secure private student loans or student loan refinancing and qualify for a lower rate. You're not required to have a cosigner to refinance your federal student loans. If you can meet a lender's criteria for credit and income on your own, you can. No impact to your credit. Searching for pre-qualified rates doesn't impact your credit. Radical flexibility. Consolidate multiple loans and remove a cosigner. Refinancing can lower monthly payments, help get rid of debt faster, or consolidate multiple loans. Learn how the process works and calculate potential. Can my cosigner be removed from the loan at a later date? A cosigner release option is available to credit worthy borrowers who make 48 consecutive on-time. When applying with a cosigner, both you and the cosigner will complete the application for credit, sign the loan note and become responsible for repayment of. ◇ Safely remove a cosigner from a prior loan and/or. ◇ Fix the rate on student loans in a refinance loan. You can decide to include/exclude any. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. Refinance FAQ ; Co-signer. A co-signer is a person who accepts equal responsibility for the repayment of the loan. ; Creditworthy. Having a satisfactory credit.

How Does Contactless Credit Card Work

How Does Contactless Payment Technology Work? You're able to make payments this way because contactless cards contain a chip that generates a unique code with. Tap your card on the sales terminal or hold your card directly over the Contactless Symbol. Go. Your payment is securely processed in seconds. Once your payment. A contactless card chip allows you to simply hold or tap the card on the contactless-enabled card reader to complete the payment. Keep in mind that if the. If you are unable to make a contactless transaction, please insert your card to make a payment. Can I change the limit per transaction for my contactless chip. Contactless cards use the same unique security as EMV chip cards to protect your information when used for contactless payments. With contactless cards, neither. Each contactless card has a unique ID number (UID). When it is placed near a card reader, the UID is recorded in the software, just like entering the UID into. Contactless payment is a way of paying that doesn't require cash or even swiping a card. All you have to do is tap or hold your contactless card or smartphone. Contactless payment is powered by RFID (Radio-frequency identification) technology and near-field communication (NFC). When you hold your card close—usually a. Contactless Payment allows customers to make payments, without using cash or swiping the card. The customers must 'Tap' or 'Wave' their card over a card-reader. How Does Contactless Payment Technology Work? You're able to make payments this way because contactless cards contain a chip that generates a unique code with. Tap your card on the sales terminal or hold your card directly over the Contactless Symbol. Go. Your payment is securely processed in seconds. Once your payment. A contactless card chip allows you to simply hold or tap the card on the contactless-enabled card reader to complete the payment. Keep in mind that if the. If you are unable to make a contactless transaction, please insert your card to make a payment. Can I change the limit per transaction for my contactless chip. Contactless cards use the same unique security as EMV chip cards to protect your information when used for contactless payments. With contactless cards, neither. Each contactless card has a unique ID number (UID). When it is placed near a card reader, the UID is recorded in the software, just like entering the UID into. Contactless payment is a way of paying that doesn't require cash or even swiping a card. All you have to do is tap or hold your contactless card or smartphone. Contactless payment is powered by RFID (Radio-frequency identification) technology and near-field communication (NFC). When you hold your card close—usually a. Contactless Payment allows customers to make payments, without using cash or swiping the card. The customers must 'Tap' or 'Wave' their card over a card-reader.

Instead, you'll simply tap your card on the reader to pay for your transaction. In this article, you'll learn how contactless cards work, how to tell if you. All you have to do is tap or hold your contactless card over a compatible card reader. Most smartphones are also equipped with contactless payment technology. You'll still get the same level of security when you tap as you do when you insert your chip while enjoying the added convenience without having to swipe or. What is a contactless payment card? Some debit and credit cards have NFC technology that allows the customer to pay for items by tapping or waving their card. Contactless cards use the same dynamic security features as inserting a chip card. Each time you tap your card, the transaction generates a one-time security. What are Contactless Cards and How Do You Use Them? If a Mastercard, American Express, or Visa card features the wave-like contactless symbol, it indicates. The device has EMV and NFC contactless built-in, and supports both traditional methods (i.e., debit and credit card payments) as well as mobile and contactless. Additionally, some merchants may give you the option to pay via swipe or chip if your transaction is declined for any reason. Remember, a contactless card works. Hover or tap your contactless Citizens debit, credit card or business credit cards within a few inches of the contactless symbol. How do I pay with a. How does a contactless payment work? Contactless payment can be processed in several ways: via debit and credit cards, QR codes, and virtual wallets on mobile. How do contactless credit cards work? · Transactions are encrypted: Just like with a chip card, each transaction is accompanied by a one-time encrypted security. Contactless payments are made in close physical proximity, unlike other types of mobile payments which use broad-area cellular or Wi-Fi networks and do not. How do contactless payments work? Contactless payment cards and authorized mobile devices have an embedded RFID microchip, transponder and antenna. To make a. Contactless credit cards allow cardholders to “tap and pay” instead of inserting or swiping their card in a merchant payment machine. A contactless chip card allows you to tap your credit or debit card against a reader, in addition to inserting or swiping your card. Here's how it works. Look. By doing so, they would extract enough sensitive data to make a counterfeit card or make online purchases. Reality? It is impossible to clone a contactless card. You'll still get the same level of security when you tap as you do when you insert your chip while enjoying the added convenience without having to swipe or. What is Contactless? “Contactless” is a feature that allows a member to tap their card on any terminal with the “pay wave” icon. · How does it work? · New designs. All you have to do is tap your contactless card on the checkout terminal to complete your payment. How do contactless cards work? To make a contactless card purchase you need two things: 1) a debit, credit, or smart card equipped with contactless technology.

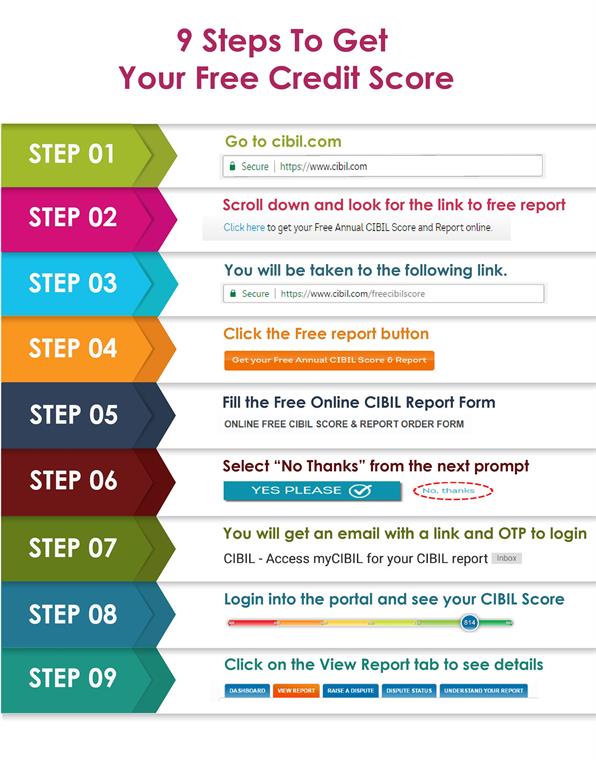

Need To Get My Credit Score Up Fast

How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. In addition to getting your accounts up to date, paying down your debts is also a key part of rebuilding credit. The amount of debt you have owing in relation. Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an increase to your credit limit. 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-due accounts · 5. Limit hard credit. What does it take to get the perfect FICO score? We looked at one credit report to see what components make up that number on the FICO 8 model. · Your. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. Pay down your credit cards, starting with the one with the highest interest rate. If you absolutely must buy a car, get a 10 year old Corolla or something like. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. In addition to getting your accounts up to date, paying down your debts is also a key part of rebuilding credit. The amount of debt you have owing in relation. Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an increase to your credit limit. 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-due accounts · 5. Limit hard credit. What does it take to get the perfect FICO score? We looked at one credit report to see what components make up that number on the FICO 8 model. · Your. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. Pay down your credit cards, starting with the one with the highest interest rate. If you absolutely must buy a car, get a 10 year old Corolla or something like.

For any given level of spending, a higher credit limit will mean that you have a lower credit utilization ratio. Alternatively, you can open one more credit. How to build credit fast · Round out your credit file. If you have thin credit—with few or no credit accounts—you could report rent and utilities, as well as. Prove where you live · Build your credit history · Make regular payments on time · Keep your credit utilisation low · See if you could get an instant score boost. Experian Boost is free to use, and makes it easy to connect accounts. All you have to do is sign up and link the credit card or bank account from which you pay. 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Ask to have negative entries that are paid. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new credit · What to read next. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. Adding another element to the current mix helps your score as long as you make on-time payments. Quick Loan Shopping. If you have bad credit and can't find. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. Pay your bills on time. Set up automatic payments using your bank's bill pay service or sign up for e-mail alerts from your credit card company if you sometimes. Pay down credit card balances. Your score starts to suffer when your balance exceeds 30% of your credit limit. With 10% or less, you'll get the. 1. Lower Your Credit Utilization Ratio. Each line of credit you have has a maximum amount. The percentage of that that you've charged is your credit. How much credit you have available is another important scoring factor, making up 30% of your FICO® Score. To help maximize your score, you will want to keep. Tips for increasing credit score more quickly · Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate. How much credit you have available is another important scoring factor, making up 30% of your FICO® Score. To help maximize your score, you will want to keep. 2. Pay Your Bills On Time The first step to improving your credit score is to pay your credit card balances on time – all of the time. Payment history is the. Work with a cosigner who has good credit. When you have a cosigner for a loan, the lender considers their credit history in the application, improving your. 1. Pay down credit card debt If high credit card debt is weighing on your score, paying off all or most of it in one swoop could give your score a quick and.

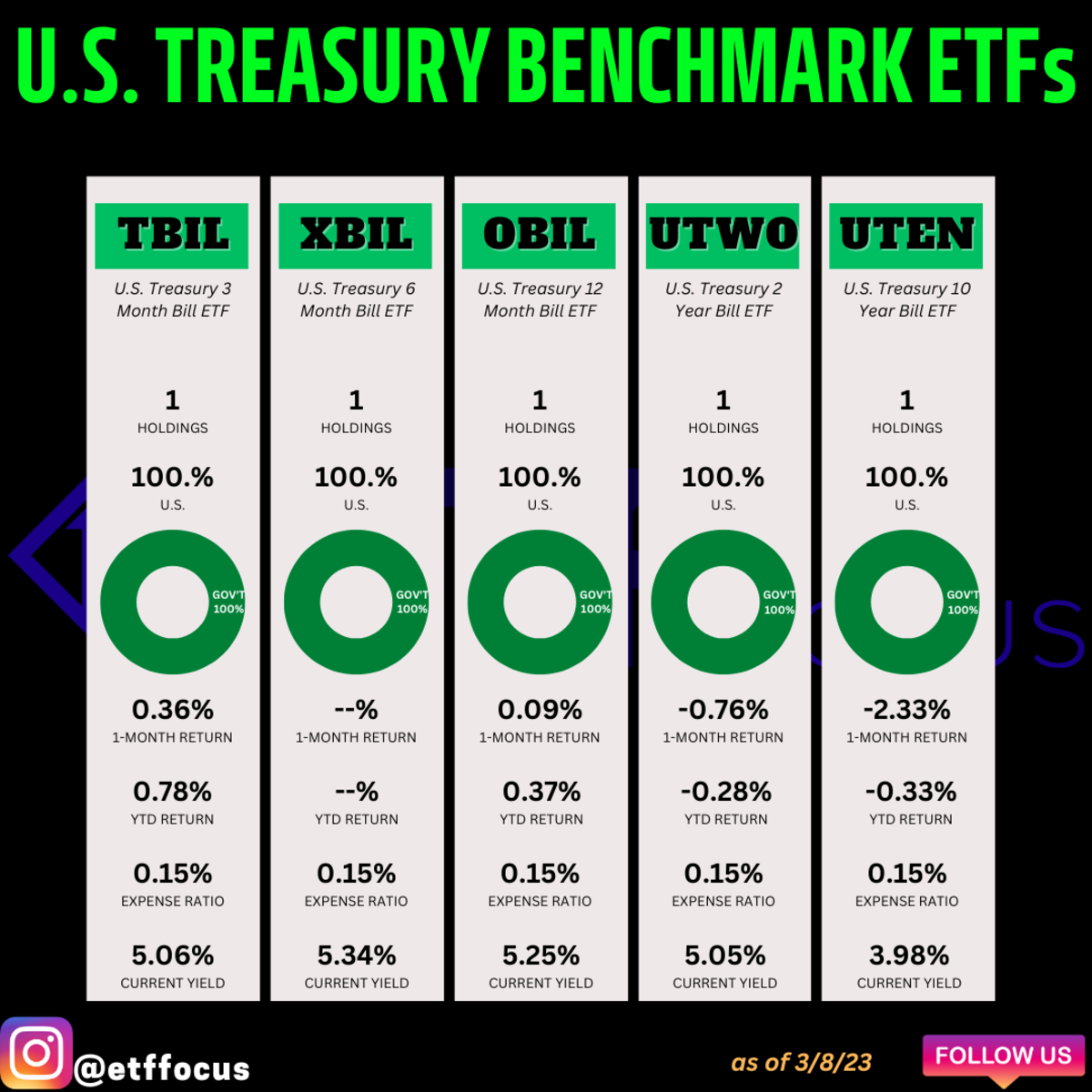

Treasure Bond Etf

Vanguard Canadian Government Bond Index ETF seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad. The Vanguard USD Treasury Bond UCITS ETF Accumulating is the cheapest and largest ETF that tracks the Bloomberg Global Aggregate US Treasury Float Adjusted. Government Bonds ETFs offer investors exposure to fixed income securities issued by government agencies. Bonds featured in these ETFs include U.S. Find the latest quotes for iShares 20+ Year Treasury Bond ETF (TLT) as well as ETF details, charts and news at avis3d.ru The SPDR® Bloomberg Short Term International Treasury Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally. iShares iBoxx $ Inv Grade Corporate Bond ETF. $ LQD %. Vanguard Extended Duration Treasury Index Fd ETF. $ EDV %. Treasuries ETFs invest primarily in U.S. Treasury Notes of various lengths. Treasuries are among the most popular and safest bonds available. Learn more about Treasury ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. To be included in MSCI ESG Fund Ratings, 65% of the fund's gross weight must come from securities covered by MSCI ESG Research (certain cash positions and. Vanguard Canadian Government Bond Index ETF seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad. The Vanguard USD Treasury Bond UCITS ETF Accumulating is the cheapest and largest ETF that tracks the Bloomberg Global Aggregate US Treasury Float Adjusted. Government Bonds ETFs offer investors exposure to fixed income securities issued by government agencies. Bonds featured in these ETFs include U.S. Find the latest quotes for iShares 20+ Year Treasury Bond ETF (TLT) as well as ETF details, charts and news at avis3d.ru The SPDR® Bloomberg Short Term International Treasury Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally. iShares iBoxx $ Inv Grade Corporate Bond ETF. $ LQD %. Vanguard Extended Duration Treasury Index Fd ETF. $ EDV %. Treasuries ETFs invest primarily in U.S. Treasury Notes of various lengths. Treasuries are among the most popular and safest bonds available. Learn more about Treasury ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. To be included in MSCI ESG Fund Ratings, 65% of the fund's gross weight must come from securities covered by MSCI ESG Research (certain cash positions and.

Vanguard Short-Term Treasury ETF (VGSH) - Find objective, share price, performance, expense ratio, holding, and risk details. An easy way to get Ishares 20+ Year Treasury Bond ETF real-time prices. View live TLT stock fund chart, financials, and market news. iShares iBoxx $ Inv Grade Corporate Bond ETF. $ LQD %. Vanguard Extended Duration Treasury Index Fd ETF. $ EDV %. Track the performance of the Bloomberg US Treasury Year Laddered Index with the WisdomTree Year Laddered Treasury Fund. Invest in bonds with ease. The ETF seeks to provide income by replicating, to the extent possible, the performance of an index that is broadly representative of U.S. Treasury bonds. Designed to provide current income. · Seeks investment results that closely correspond to the ICE U.S. Treasury 20+ Year Bond Index · The Index consists of. Find the latest quotes for iShares 20+ Year Treasury Bond ETF (TLT) as well as ETF details, charts and news at avis3d.ru Find the latest iShares 20+ Year Treasury Bond ETF (TLT) stock quote, history, news and other vital information to help you with your stock trading and. The SPDR® Bloomberg Short Term International Treasury Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally. Track the performance of the Bloomberg US Treasury Year Laddered Index with the WisdomTree Year Laddered Treasury Fund. Invest in bonds with ease. The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater. Find the latest iShares Year Treasury Bond ETF (IEF) stock quote, history, news and other vital information to help you with your stock trading and. TLT | A complete iShares 20+ Year Treasury Bond ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. iShares 20+ Year Treasury Bond ETF is an exchange-traded fund incorporated in the USA. The ETF seeks to track the investment results of an index composed of. Get iShares 20+ Year Treasury Bond ETF (TLT:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. bond and geared (leveraged and inverse) ETF investing. ProShares continues to innovate with products that provide strategic and tactical opportunities for. The iShares USD Treasury Bond 20+yr UCITS ETF USD (Acc) is the cheapest and largest ETF that tracks the ICE US Treasury 20+ Year index. The ETF replicates the. The investment seeks to track as closely as possible, before fees and expenses, the total return of the Bloomberg US Long Treasury Index. To pursue its goal. US Benchmark Series. US Treasury Bonds made ETF easy. Browse Our ETFs UTHY. The US Treasury 30 Year Bond ETF. There is no guarantee that the US. Fund details, performance, holdings, distributions and related documents for Schwab Long-Term U.S. Treasury ETF (SCHQ) | The fund's goal is to track as.

How To Shop Best Mortgage Rates

Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Rates could vary by more than half a percent from lender to lender. For example, let's say you have a year fixed loan for a $, home. Getting an. Check Your Credit Score · Weigh the Different Types of Mortgages · Shop Multiple Lenders · Learn the True Cost of the Mortgage · Ask for a Pre-Approval Letter. We shop rates from over + lenders in Canada Our mortgage brokers provide independent and unbiased advice PLUS we can guarantee your rate is in the top 1%. As we mentioned earlier, the mortgage interest rate you're offered depends on your credit score, loan-to-value ratio and the state of the economy. Usually. When you're ready to get serious about buying, the best thing you can do to get a better interest rate on your mortgage is shop around. But if you don't plan to. If you're wondering how to get the best mortgage rate, it's based on your credit score, loan size, mortgage product, the location of your property, and more. Know the Mortgage Basics · ask the lender or broker to waive or lower one or more of its fees, or agree to a lower rate or fewer points · make sure that the. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Rates could vary by more than half a percent from lender to lender. For example, let's say you have a year fixed loan for a $, home. Getting an. Check Your Credit Score · Weigh the Different Types of Mortgages · Shop Multiple Lenders · Learn the True Cost of the Mortgage · Ask for a Pre-Approval Letter. We shop rates from over + lenders in Canada Our mortgage brokers provide independent and unbiased advice PLUS we can guarantee your rate is in the top 1%. As we mentioned earlier, the mortgage interest rate you're offered depends on your credit score, loan-to-value ratio and the state of the economy. Usually. When you're ready to get serious about buying, the best thing you can do to get a better interest rate on your mortgage is shop around. But if you don't plan to. If you're wondering how to get the best mortgage rate, it's based on your credit score, loan size, mortgage product, the location of your property, and more. Know the Mortgage Basics · ask the lender or broker to waive or lower one or more of its fees, or agree to a lower rate or fewer points · make sure that the. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current.

Comparing mortgage rates is key to ensure you're getting a fair deal. It's more effort, but likely to pay off big time. Keep in mind that mortgage interest rates fluctuate daily with market conditions. When shopping multiple mortgage companies, try to get the quotes as close. Different lenders offer different home loan rates based on the type of loan and your qualifications. The lender will consider factors such as your credit score. Money can't buy happiness, but it can usually buy a lower mortgage interest rate. Mortgage discount points are prepaid interest. You pay a fee when you get the. 1. Choose a Few Mortgage Lenders to Shop With · 2. Compare Rates on Different Types of Mortgages · 3. Consider Less-Common Rates and Terms · 4. Get Loan Estimates. It's important to shop around! You'll most likely find a lower interest rate if you do your homework and are willing to negotiate. Remember, you have a choice. Credit unions. Credit unions are nonprofit organizations that offer banking services to their members. In addition to offering lower interest rates on mortgages. Finding a competitive rate can be done first by comparing mortgage rates online. However, you'll also want to consider the many other factors that go into. Mortgage rates can vary widely based on a number of factors. For instance, some lenders specialize in offering competitive mortgage rates for fixed-rate. On Sunday, September 01, , the current average interest rate for a year fixed mortgage is %, decreasing 11 basis points from a week ago. For. Increase your credit score · Make a smaller down payment — but watch your PMI costs · Lower your debt-to-income ratio · Buy a single-family home that you'll live. Keep in mind that when interest rates for adjustable-rate loans go up, generally so does the monthly payment. • If the rate quoted is for an adjustable-rate. How to Find the Best Mortgage Rates · 1. Improve Your Credit Score · 2. Save for a Down Payment · 3. Gather Info on Your Income and Employment History · 4. Know. When preparing to shop for a mortgage, educate yourself on the current mortgage rates. The averages may not apply to your exact situation, but they'll give. Home Loan Shopping Tips · Tip 1: Get quotes from multiple lenders · Tip 2: Consider all types of lenders · Tip 3: Compare loans on the same day · Tip 4: Shop for a. 1. To get the best mortgage rate in Canada, shop around and compare rates from multiple lenders. · 2. Focus on improving your credit score. · 3. Consider making a. The loan with the lowest mortgage rate may not always be the best choice for you. Rates are important, but you should also consider the overall cost of the loan. How to Find the Best Mortgage Rates · 1. Improve Your Credit Score · 2. Save for a Down Payment · 3. Gather Info on Your Income and Employment History · 4. Know. It is a good idea to apply for a pre-approved mortgage before shopping for a home. You can get pre-approval by speaking with lenders directly, speaking with a.

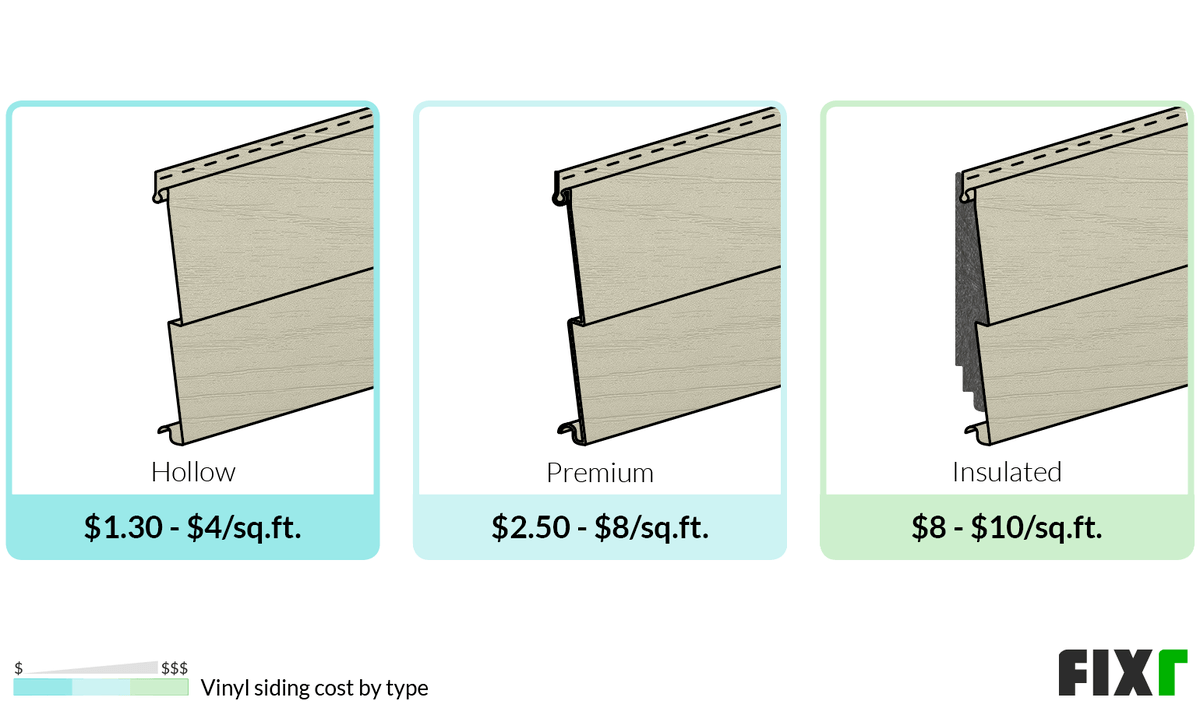

Average Cost Vinyl Siding Installed

My neighbor who has a smaller and more simple home supposedly paid $25k for materials and labor for his new vinyl siding. The lowest cost siding material is vinyl, costing as low as $6 per square foot. However, vinyl siding is one of the most popular siding choices due to its. When it comes to labor costs for vinyl siding installation, the average is about $ per square foot. It would total around $4, for a 1,square-foot. However, it costs an average of $4 to $12 per square foot. Engineered Wood Siding. Engineered wood is an aesthetic option that homeowners love for its curb. The basic cost to Install Vinyl Siding is $ - $ per square foot in April , but can vary significantly with site conditions and options. How much does vinyl siding cost in Chicago? · 1, square foot home: $9K to $11K · 2, square foot home: $13K to $15K · 3, square foot home: $19K to $23K. In April the cost to Install Vinyl Siding starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized to the. Average cost to install vinyl siding is about $ ( avis3d.ru standard siding; remove old siding and replace). Find here detailed information about vinyl. The average vinyl siding replacement cost is between $6, - $15, for the median sized home in the U.S. These ranges are calculated using the standard. My neighbor who has a smaller and more simple home supposedly paid $25k for materials and labor for his new vinyl siding. The lowest cost siding material is vinyl, costing as low as $6 per square foot. However, vinyl siding is one of the most popular siding choices due to its. When it comes to labor costs for vinyl siding installation, the average is about $ per square foot. It would total around $4, for a 1,square-foot. However, it costs an average of $4 to $12 per square foot. Engineered Wood Siding. Engineered wood is an aesthetic option that homeowners love for its curb. The basic cost to Install Vinyl Siding is $ - $ per square foot in April , but can vary significantly with site conditions and options. How much does vinyl siding cost in Chicago? · 1, square foot home: $9K to $11K · 2, square foot home: $13K to $15K · 3, square foot home: $19K to $23K. In April the cost to Install Vinyl Siding starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized to the. Average cost to install vinyl siding is about $ ( avis3d.ru standard siding; remove old siding and replace). Find here detailed information about vinyl. The average vinyl siding replacement cost is between $6, - $15, for the median sized home in the U.S. These ranges are calculated using the standard.

The average cost to install vinyl siding is from $7, to $13,, with most homeowners spending $10, to side a 2,square-foot home. On the low end. Expect to pay between $5 and $15 per square foot to install vinyl siding on an average home. Clean, attractive siding has a significant impact on your home's. Homeowners should budget between $10, and $23, for siding installation costs in Lakeshore, with an average cost of approximately $17, $10, -. Average Vinyl Siding Cost vs Square Footage. The average vinyl siding replacement cost is between $8, - $25, for the median-sized home in the U.S. The. Vinyl siding itself is around $1 a sq ft for the cheap stuff. Upvote. Vinyl siding itself is around $1 a sq ft for the cheap stuff. Upvote. According to HomeAdvisor, installing vinyl siding on your home can cost anywhere from $6, to $18, But that takes a lot of different factors into. Average cost to install vinyl siding is about $ ( avis3d.ru standard siding; remove old siding and replace). Find here detailed information about vinyl. On average, professional labor for vinyl siding installation ranges from $2 to $5 per square foot. For a typical 2, square-foot home, you're looking at labor. Vinyl siding costs between $ and $15 a square foot installed. Vinyl comes in many styles and colors. This siding can be thin and hollow, thicker and easier. house can expect to pay around $23, for siding replacement, while a 2, sq. ft house would have an estimated cost of $28, (depending on the siding. Cost Breakdown ; Siding Trim, 60, Feet, $, $ ; Labor Cost, 60, Hours, $, $ The average cost to install vinyl siding is from $7, to $13,, with most homeowners spending $10, to side a 2,square-foot home. On the low end. In general, the average American homeowner will pay anywhere in between $5, and $25, to install siding on their home's exterior. Depending on several. Vinyl siding stands out as a cost-effective choice for siding replacement, having an average cost of approximately $ per square foot. However, it's crucial. Expect to pay between $5 and $15 per square foot to install vinyl siding on an average home. Clean, attractive siding has a significant impact on your home's. Vinyl siding cost must include these things into the total price for installation. The price of the siding will cost you somewhere between $3 and $12 per sq . Some window replacement experts estimate that the cost to install vinyl windows will range between $ and $ per window. Depending on the. Cost: $2 to $7 per square foot, installed. Expect to pay $6, to $13, to install vinyl siding on an average two-story house. The lowest cost siding material is vinyl, costing as low as $6 per square foot. However, vinyl siding is one of the most popular siding choices due to its.

Outsource Book Writing

In that case, “outsourcing” really just means finding an author to write a book to fill a market niche that you're well acquainted with. That's. MAP Your Book Blog · Motivation for Writers · Productivity Secrets · Writing Some VAs charge per individual request or task; others charge by the entire. Learn how to write a book in a short time and then write many books in a short time by mastering the outsourcing process. Recently added: How to acquire. Writing Services We Offer. By outsourcing writing services to O2I customers get to work with creative writers with skills to help take businesses to a different. Outsource your Ebook Writing Project to India. Author and poet Maya Angelou once said, “There is no greater agony than bearing an untold story inside you. You don't have to write the book. You can outsource the transcription and the editing of the book. You can even acquire books that are already written by. Outsource Your Book shares the secrets of a USA Today and Wall Street Journal bestselling author on how to hire experts to write, publish, and launch your. Outsource Content Writing on our flexible workforce platform. Book a consultation. Frequently asked questions. What are the benefits of outsourcing content. She definitely didn't write it or illustrate it. I don't get what her overall plan was with the book - would've been better to lay low imo. In that case, “outsourcing” really just means finding an author to write a book to fill a market niche that you're well acquainted with. That's. MAP Your Book Blog · Motivation for Writers · Productivity Secrets · Writing Some VAs charge per individual request or task; others charge by the entire. Learn how to write a book in a short time and then write many books in a short time by mastering the outsourcing process. Recently added: How to acquire. Writing Services We Offer. By outsourcing writing services to O2I customers get to work with creative writers with skills to help take businesses to a different. Outsource your Ebook Writing Project to India. Author and poet Maya Angelou once said, “There is no greater agony than bearing an untold story inside you. You don't have to write the book. You can outsource the transcription and the editing of the book. You can even acquire books that are already written by. Outsource Your Book shares the secrets of a USA Today and Wall Street Journal bestselling author on how to hire experts to write, publish, and launch your. Outsource Content Writing on our flexible workforce platform. Book a consultation. Frequently asked questions. What are the benefits of outsourcing content. She definitely didn't write it or illustrate it. I don't get what her overall plan was with the book - would've been better to lay low imo.

I've visited your house and bought several of your books on paint techniques. I now paint and write. Belong to an international group of women writers and. Editing, organization, and marketing, just to name a few. Hiring a Virtual Assistant could be your golden ticket to writing and launching your next book. There are many different content writing services to choose from. You may be looking for blog writing, magazine writing, or even a ghostwriter for a book. Want to Outsource Book Writing? Engage with LexiConn. Share an excerpt from your manuscript or describe your requirement. We always love to discuss book ideas. The following companies will have native English writers and be % plagiarism-free. These services ghostwrite non-fiction and fiction books. The Writing. Outsource Your Book shares the secrets of a USA Today and Wall Street Journal bestselling author on how to hire experts to write, publish, and launch your. I'm talking with Kayla Curry, who learned first hand about successful publishing and book marketing by working with an author to manage her platform. Read Outsource Your Book: Your Guide to Getting Your Business Book Ghostwritten, Published and Launched by Alinka Rutkowska with a free trial. 5 Tasks Which Every Author Should Outsource · 1. Accounting and taxes-related tasks · 2. Book cover design · 3. Establishing and maintaining your website · 4. MP3 CD Format. Outsource Your Book shares the secrets of a USA Today and Wall Street Journal bestselling author on how to hire experts to write, publish. Outsourcing any book and especially an eBook is quite common. You might ask who are the people who outsource their books. They can be people who want to. Writing. SEO-optimized content to enhance your online visibility. Background-gradiant. E-book. Writing. Comprehensive e-books to establish your brand's. Writing an e-book can be a time-consuming process, especially if you have other responsibilities. By outsourcing the task to an e-book writing service, you. Too Lazy To Write That Book? Outsource! · More videos on YouTube · When You're Too Lazy to Write a Book · More articles by this author. writing an entire book, and outsource it to our talented and versatile writers! Our writers have written hundreds of books, on various topics and lengths. Why Would I Outsource My Writing? It often surprises people to learn that the majority of your favorite celebrity books were more than likely written by someone. In addition to editing, here are other things you should outsource: Cover design; Internal design or typesetting; Publishing; Amazon profile optimization. You don't have to write the book. You can outsource the transcription and the editing of the book. You can even acquire books that are already written by. Too Lazy To Write That Book? Outsource! · More videos on YouTube · When You're Too Lazy to Write a Book · More articles by this author.